In the realm of professional services, Certified Public Accountants (CPAs) and owners of accounting firms have a role in managing financial matters for both businesses and individuals. However, besides offering guidance, it is equally essential for CPAs and accounting firm owners to ensure their profitability. This comprehensive guide will explore approaches that can effectively maximize profit for CPAs and accounting firms, ensuring long-term growth and success.

Professional service revenue refers to the earnings derived from offering expertise, skills, and services to clients. It represents the financial compensation received by professionals like consultants, accountants, lawyers, architects, and other service providers for the assistance they provide to individuals, businesses, or organizations. Accounting, tax preparation, bookkeeping, and payroll services firms generated an average net profit margin of 19.6%.

In the case of a CPA or accounting firm, professional service revenue encompasses accounting services for which fees are earned. These are as follows-

Revenue is earned by preparing and filing tax returns offering guidance on tax strategies and assisting clients in optimizing their tax obligations.

Fees are charged for conducting audits, reviews, and compilations to ensure compliance with accounting standards.

Earnings are generated by providing advice, analysis, and recommendations that enable clients to make informed decisions regarding their finances, investments, and business operations.

Compensation received for maintaining records, reconciling accounts, and producing financial statements on behalf of clients.

Revenue is obtained by processing payroll activities such as calculating employee salaries, deductions, and tax withholdings.

Trust fees are charged for helping clients with the creation of estate plans, trusts, and strategies to safeguard and transfer their assets.

Earnings are obtained by providing valuation services to determine the value of a business or its assets for purposes such as mergers, acquisitions, or financial reporting.

Revenue is generated through the investigation of irregularities, fraud cases, and disputes that often require litigation support.

Fees are charged for evaluating and implementing controls to minimize risks and ensure compliance with regulations.

Revenue from professional services plays a role in the financial performance of service-based businesses. It serves as a measure of the value delivered to clients. It is essential for covering operational expenses generating profits, and supporting growth strategies. Ensuring tracking and effective management of service revenue are critical in maintaining the financial well-being and long-term viability of CPA firms or accounting companies.

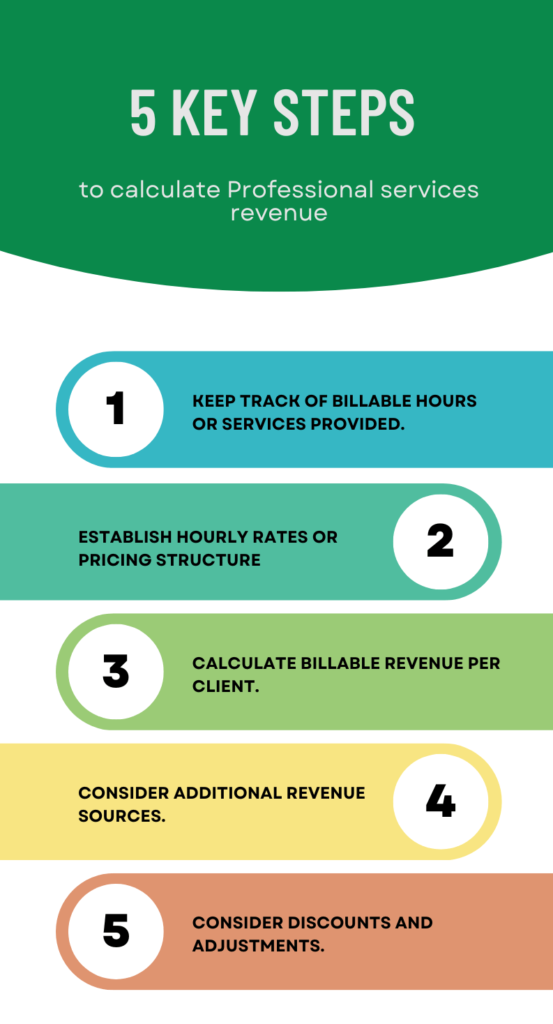

Calculating the revenue for services is a part of effectively managing the financial well-being of your CPA or accounting firm. Here I present to you five steps to accurately determine your service revenue;

The foundation for calculating service revenue lies in maintaining records of billable hours or services offered to clients. It is important to document the time spent on tasks, projects, or consultations for each client engagement. This could encompass activities such as tax preparation, financial analysis, audit work, consulting services, and more.

Set consistent pricing for your services. Determine rates for each team member or consider a fixed fee structure for specific services provided. These rates may vary depending on factors like task complexity, required expertise level, and industry standards. It is crucial that your pricing reflects the value you bring to clients while remaining competitive within the market.

Multiply the recorded hours by the hourly rates applicable to each client engagement. For instance, if you provided 10 hours of tax consulting at a rate of $150 per hour, the billable revenue generated from that client would amount to $1,500.

To determine your revenue, you need to sum up the revenue earned from all clients.

Aside from hours, your accounting or advisory firm may generate revenue from sources. These can include;

(i) Recurring Services; annual retainer fees for accounting or advisory services.

(ii) Value Added Services; Revenue generated by providing additional services like financial planning, software training, or specialized consulting.

(iii) Product Sales; If your firm sells accounting software templates or other resources, include the revenue earned from these sales.

(iv) Referral Fees; Revenue received for referring clients to service providers (if.

Include these sources of revenue in your calculation to determine your professional service revenue.

Take into account any discounts, refunds, or adjustments provided to clients. This can include volume discounts, special promotions, or instances where you’ve had to revise invoices. Subtract these adjustments from your service revenue to obtain your net revenue.

By following these steps, you’ll be able to calculate the service revenue of your CPA or accounting firm and gain insights into its financial performance.

To guarantee the profitability and growth of your company, it is crucial to conduct revenue calculations, examine patterns, and make informed choices.

Revenue from professional services plays a role in the financial performance of service-based businesses. It serves as a measure of the value delivered to clients. It is essential for covering operational expenses generating profits, and supporting growth strategies. Ensuring tracking and effective management of service revenue are critical in maintaining the financial well-being and long-term viability of CPA firms or accounting companies.

Profitability is the foundation for any business, including CPA and accounting firms. It does not sustain day-to-day operations. It also drives growth, innovation, and the provision of top-notch services. To unlock the potential of profit in services, it’s essential to consider the following strategies;

Operational efficiency plays a role in maximizing profits. By implementing practice management systems, you can streamline processes, automate repetitive tasks, and minimize manual errors. This optimization allows you to allocate time and resources towards high-value tasks that directly influence client satisfaction and overall profitability.

Recognize that not all clients have needs or growth potential. By categorizing clients based on complexity, needs, and growth prospects, you can effectively allocate resources, customize service offerings accordingly, and price them based on the value they receive. Nurturing high-value clients leads to client retention rates. Increases the overall worth of each engagement.

Consider transitioning from billing methods to value-based pricing models. This approach ensures that your fees align with the value you provide to clients.

It promotes openness, builds trust, and enables you to receive a portion of the value you bring to the table. Value-based pricing does not benefit clients. Also ensures that your firm remains profitable.

Embrace technology as a means to drive profit. Invest in accounting software, data analytics tools, and cloud-based platforms to provide real-time insights, data-driven recommendations, and improved collaboration. Automation reduces work, enhances accuracy, and allows you to efficiently cater to a client base.

A strong brand presence can have an impact on your firm’s profitability. Develop a marketing strategy that showcases your expertise presents client success stories, and positions your firm as a trusted leader in the industry. Engage in thought leadership through webinars, whitepapers, and speaking engagements to attract clients while retaining existing ones.

Your team is your asset. Foster a culture of learning, professional growth, and collaboration. When employees feel valued and empowered, they are more likely to provide service, which leads to clients and increased referrals—ultimately driving overall profitability.

Look for opportunities to expand the range of services you offer. As the financial landscape evolves, the needs of clients also change. By venturing into related areas, like planning, business consulting, or tax optimization, you can tap into avenues of revenue and cross-sell to your existing clientele.

Contented clients are likelier to become repeat customers and advocates for your firm. Prioritize delivering service that surpasses expectations while maintaining lines of communication. Regularly seek feedback from clients to gain insights into their needs and preferences, ensuring that your services align with what they expect.

In this modern world, it’s not just about making money; it’s also about having a strategic approach. By following the strategies mentioned in this guide, owners of CPA and accounting firms can unlock their profit potential. Achieve sustainable growth and success. From improving efficiency and implementing value-based pricing to integrating technology and managing talent, every aspect contributes to an overall approach that ensures your firm remains profitable, adaptable, and well-prepared for long-term prosperity.

Remember, profitability isn’t about the aspect; it’s also about providing value to clients building relationships, and making a positive impact on the businesses and individuals you serve. As you embark on this journey to maximize profits, keep in mind that each step you take brings you closer to a future filled with success and professional satisfaction.

To tackle the challenge of calculating professional service revenue, you will need experts dedicated help. Contact us today to automate your accounting and bookkeeping process for your professional service business.

Hello,

Thanks for visiting our website!

How can we help you?

Start the chat

WhatsApp us